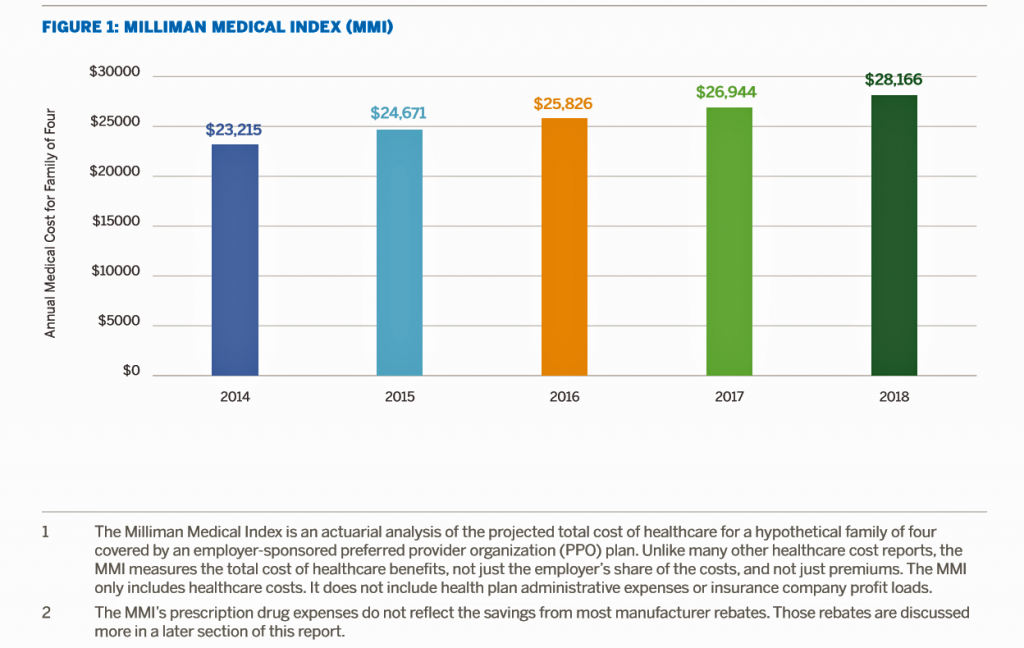

What could $28,166 buy you in 2018? A new car? A year of your child’s college education? A plot of land for your retirement home?

What could $28,166 buy you in 2018? A new car? A year of your child’s college education? A plot of land for your retirement home?

Or a year of healthcare for a family of four?

Welcome to this year’s edition of the Milliman Medical Index (MMI), one of the most important forecasts of the year in the world of the Health Populi blog and THINK-Health universe. That’s because we’re in the business of thinking about the future of health and health care through the health economics lens; the MMI is a key component of our ongoing environmental analysis of the health/care landscape, and we include it in nearly every presentation and talk  we give to every audience.

we give to every audience.

The MMI represents what a typical employer-sponsored preferred provider organization (PPO) plan covering a family of four will cost in 2018. The $28,166 includes inpatient facility care (e.g., hospitalizations), outpatient facility care (e.g., hospital clinic visits, ambulatory surgeries), professional services (e.g., physician office visits), pharmacy (e.g., outpatient prescription drugs via mail order, retail pharmacy), and other services (e.g., home healthcare, ambulance services, durable medical equipment).

The good news, Milliman says, is that the annual rate of cost increase was the lowest in 18 years at 4.5%. Last year’s rate of growth was 4.6%. Some of the factors that have helped to moderating healthcare spending growth included provider engagement through aligning financial incentives (via accountable care, value-based payments, among other tactics), the impact of high-deductible health plans on patient’s spending (such as shopping for lower-cost imaging services and growing use of retail clinics), and the role of public/government programs.

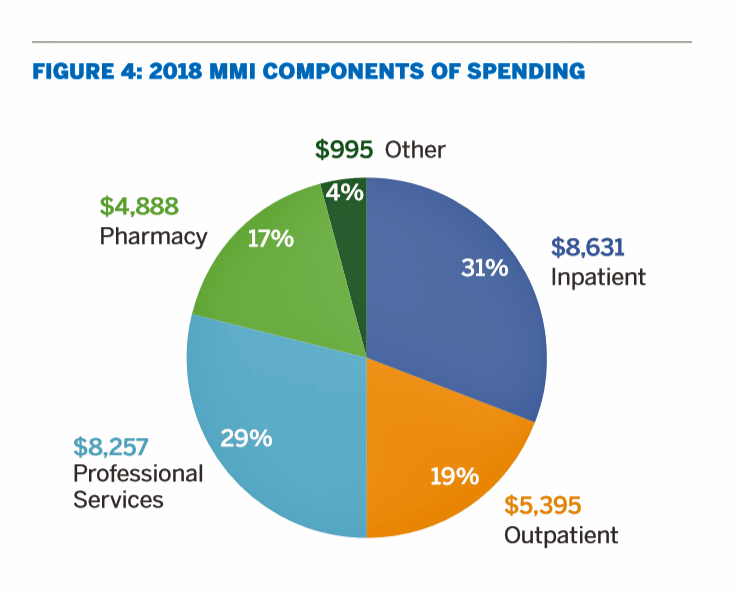

Note in the second chart that inpatient care is the largest component of medical spending, closely followed by professional services which, together, equals 60% of spending.

The pharmacy line item among the five cost components has grown to 17% of spending, which has risen as a component of spending in the MMI over the past few years. Milliman points out that this pharmacy number does not include drugs administered in the hospital, outpatient infusion centers, and doctors’ offices. Thus, the total pharmacy spend for families is over 20%, the Milliman team calculates.

Milliman notes that pharmacy initiatives have helped to bring costs down over the past 18 years in terms of “trend” of cost increases, driven down through the massive adoption of generics when available on the market. But the specialty drug pipeline is rich with new-new products like gene therapies and combination products whose prices may dampen efforts to reduce spending, Milliman points out. An actuary quoted in the report warned, “specialty drugs and medical pharmacy continue to trend at high rates, both on unit cost and utilization. Many of these drugs provide great social value, treating disease. At the same time, rates for certain drugs can seem unduly inflated,” a sentiment that consumers shared in recent polls. The recent announcement of the prescription drug cost regulation blueprint, “American Patients First,” speaks to President Trump’s and Secretary Azar’s focus on regulatory reforms targeting the prices of medicine.

Health Populi’s Hot Points: The MMI is a sobering reminder that health care spending is the #1 pocketbook issue for most American families. This crosses political parties: healthcare costs hit family budgets hard, and force people of all political stripes to make tough decisions about paying for food, housing, utilities, and saving for future needs.

Health Populi’s Hot Points: The MMI is a sobering reminder that health care spending is the #1 pocketbook issue for most American families. This crosses political parties: healthcare costs hit family budgets hard, and force people of all political stripes to make tough decisions about paying for food, housing, utilities, and saving for future needs.

We know that, ironically, one-half of U.S. families could not afford to pay $1,000 for an emergency medical bill in one study; in another, that inability to pay is as low as a $400 emergency to cover.

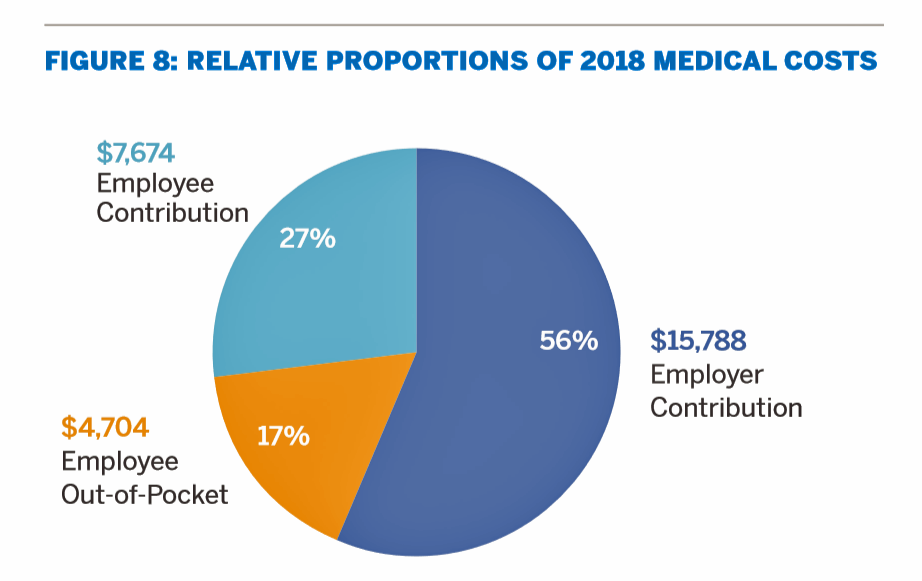

This year, Milliman notes, “employers pay more; employers pay a lot more” for healthcare spending. Employees’ share of health care costs now reach 44% of that $26,144. That equals $11,503.

The median income for a family of four in the U.S. was $59,214 in February 2018. Thus, employees’ share of health care costs will approach 20% of family income in 2018 for the typical working family covered by health insurance, based on this year’s Milliman Medical Index.

What working people know is that their wage increases stagnated for over a decade, as they traded off paycheck growth for health care coverage. The latest wage increase data shows that Americans’ wages grew by about 4.5% in March 2018 — roughly the rate of growth of healthcare spending for a family of four between 2017 and 2018, as the Milliman Medical Index noted.

In America, spending for healthcare will remain a top pocketbook issue.

A few days ago, TransUnion, the credit agency, announced plans to acquire Healthcare Payment Specialists. The company, “helps healthcare providers maximize Medicare reimbursement by focusing on payment areas where superior technology and deep domain expertise can drive significant improvements,” the press release states, focusing on helping hospitals recover Medicare bad debt as well as helping hospitals, “serving low-income populations maximize their DSH (disproportionate share hospital) reimbursement by integrating multiple data sources to identify all DSH-eligible patients and patient days.”

There will be no small number of such medical banking efforts developed to work on the provider side of the equation, as hospitals and physicians face a consumer/patient base cash-strapped to pay for healthcare.

The post Health Care for a Typical Working Family of Four in America Will Cost $28,166 in 2018 appeared first on HealthPopuli.com.

Health Care for a Typical Working Family of Four in America Will Cost $28,166 in 2018 posted first on http://drugsscreeningpage.blogspot.com/

No comments:

Post a Comment