Over four in 10 U.S. workers were enrolled in a high-deductible health plan in the first 9 months of 2017, according to the latest research published by the National Center for Health Statistics, part of the Centers for Disease Control in the U.S. Department of Health and Human Services.

Over four in 10 U.S. workers were enrolled in a high-deductible health plan in the first 9 months of 2017, according to the latest research published by the National Center for Health Statistics, part of the Centers for Disease Control in the U.S. Department of Health and Human Services.

The report details Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January-September 2017.

About 28 million people were uninsured in the U.S. in 2017, about the same proportion as in 2016 — but nearly 20 million fewer than in 2010, as the line chart illustrates.

The proportion of people enrolled in publicly-sponsored health insurance fell slightly to 19.5 million Americans in 2017. Note that 42% of children 0-17 years of age were covered through public sources.

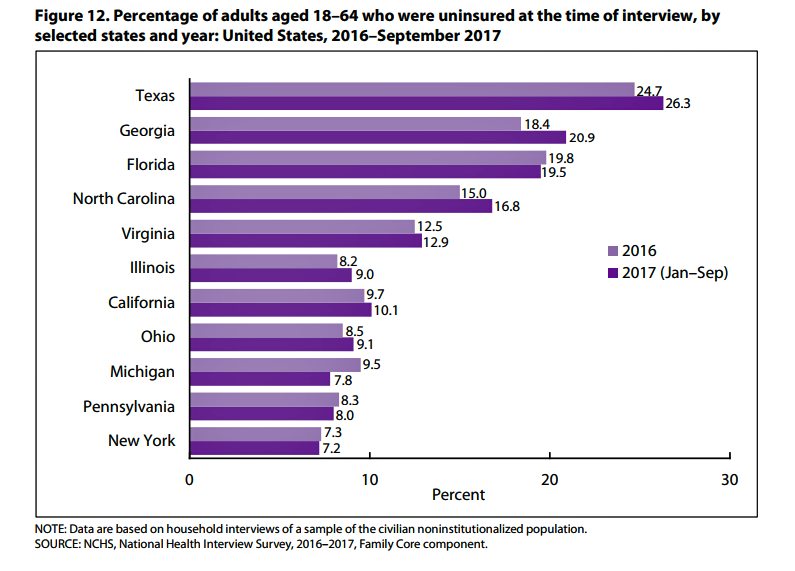

The highest levels of working-age uninsured people live in Texas, Georgia, Florida, North Carolina, and Virginia, shown in the second bar chart. Levels of the uninsured increased in most of the 11 states on the chart, except for health citizens in Florida, Michigan, Pennsylvania and New York state.

Note that the states where the rolls of uninsured people grew the most were led by Governors who chose not to expand Medicaid under the Affordable Care Act.

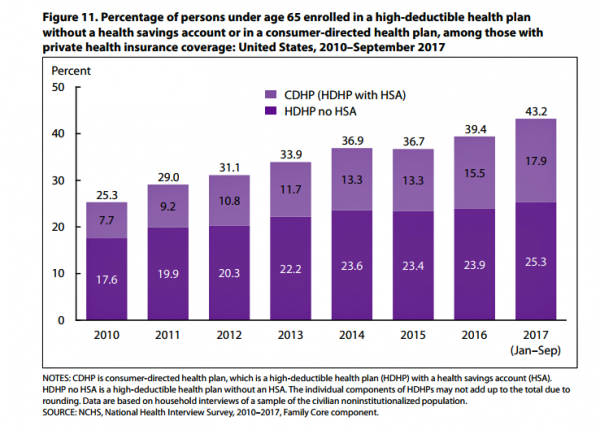

The third chart illustrates the growth in high-deductible health plans (HDHPs) with and without health savings accounts (HSAs). In the first nine months of 2017, 43.2% of working-age people (under 65 years of age) were enrolled in an HDHP: 18% in consumer-directed health plans (which are HDHPs bundled with an HSA) and 25% in an HDHP (which do not have an HSA with the plan).

The third chart illustrates the growth in high-deductible health plans (HDHPs) with and without health savings accounts (HSAs). In the first nine months of 2017, 43.2% of working-age people (under 65 years of age) were enrolled in an HDHP: 18% in consumer-directed health plans (which are HDHPs bundled with an HSA) and 25% in an HDHP (which do not have an HSA with the plan).

Health Populi’s Hot Points: Just over 3% of employers believe that high-deductible health plans are the best concept for “converting passive patients into active healthcare consumers,” according to the recently-released 8th Annual Industry Pulse survey conducted by Change Healthcare. [I covered this study earlier this week in Health Populi here in an analysis of the state of patient/health engagement].

For over a decade, through my health economics lens, I’ve pointed out the self-rationing impacts that HDHPs have had on consumers’ health behaviors, such as postponing needed healthcare services, avoiding doctors’ appointments due to cost, skipping prescription fills, cutting pills, and other avoidance “choices.”

These behaviors can feel like short-term smart fiscal options, but in the long term they can have dreadful physical outcomes.

Bundling financial wellness into health/wellness is key, and there’s a lack of dot-connecting in so many health citizens enrolled in so-called consumer-directed health plans. Patients don’t feel much like consumers facing a high-deductible, and particularly when the healthcare services they need aren’t very shop-able.

There are more tools available for patients-consumers who choose to shop for services; just this week in my own town of Philadelphia, Clear Health Costs launched Philly Price Check through two local media outlets, The Philadelphia Inquirer and 6 ABC Action News, a healthcare cost comparison tool. Expect more like this important development in the coming months — the sooner they reach the minds and pocketbooks or health care consumers, the better, in the short-run.

There are more tools available for patients-consumers who choose to shop for services; just this week in my own town of Philadelphia, Clear Health Costs launched Philly Price Check through two local media outlets, The Philadelphia Inquirer and 6 ABC Action News, a healthcare cost comparison tool. Expect more like this important development in the coming months — the sooner they reach the minds and pocketbooks or health care consumers, the better, in the short-run.

The post More Working Americans Enrolled in High-Deductible Health Plans in 2017 appeared first on HealthPopuli.com.

More Working Americans Enrolled in High-Deductible Health Plans in 2017 posted first on http://drugsscreeningpage.blogspot.com/

No comments:

Post a Comment