It takes more than enrolling in a high-deductible health plan (HDHP) for someone to immediately morph into an effective health care “consumer.”

It takes more than enrolling in a high-deductible health plan (HDHP) for someone to immediately morph into an effective health care “consumer.”

Research from Dr. Jeffrey Kullgren and his team from the University of Michigan found that enrollees in HDHPs could garner more benefits from these plans were people better informed about how to use them, including how to save for them and spend money once enrolled in them. The team’s research letter was published in JAMA Internal Medicine on 27 November 2017.

The discussion details results of a survey conducted among 1,637 people 18 to 64 years of age who have been enrolled in an HDHP for at least one year. The study over-sampled for people diagnosed with chronic health conditions (who, theoretically, are more experienced and savvy users of healthcare services).

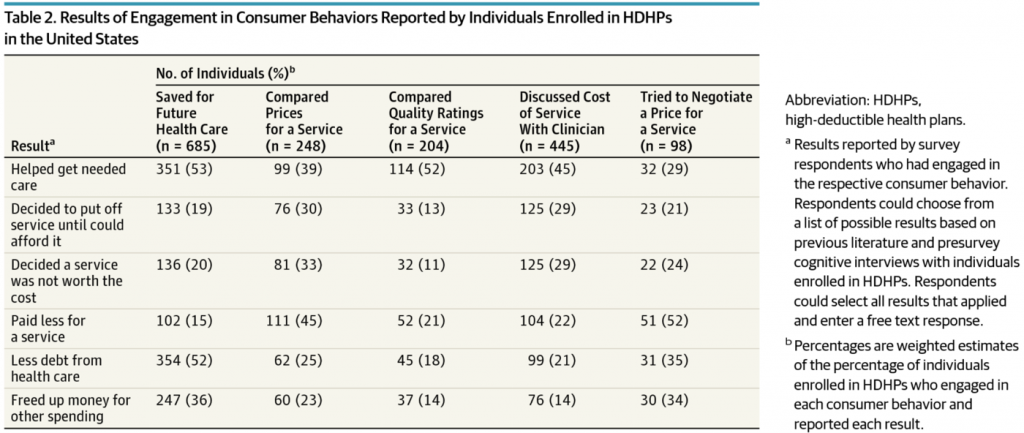

The survey looked into HDHP health plan members’ consumer behaviors such as:

- Saving for future healthcare services

- Comparing prices for a service

- Comparing quality ratings for that service

- Discussing cost for a service with clinicians

- Trying to negotiate a price for a service.

The most common healthcare consumer behavior was to save for future healthcare services, among 4 in 10 HDHP plan members. Discussing costs was the second most popular behavior, for 25% of HDHP enrollees.

The study assessed six types of healthcare services: lab tests, imaging tests, prescription medications, procedures, outpatient visits, and inpatient care. Above all, prescription medications were the top-ranked type of healthcare service/product with which consumers dealt versus the other five line items. Specifically,

- 61% of HDHP members compared prices for Rx drugs

- 66% of HDHP members discussed the cost of meds with a clinician, and

- 28% of consumers tried to negotiate a price for an Rx.

The most common health engagement tactics adopted by HDHP members were to save for future health care, discuss the cost of services with a clinician, and comparing prices for a service. The most prevalent results of these actions were that:

- For those saving for future health care, helping get needed care and having less debt due to health care spending

- For HDHP members discussing costs of services with clinicians, helping get needed care

- For folks who compared prices for services, paying less for services, getting the needed care, and deciding a service “was not worth the cost.”

Comparing quality ratings for services ranked relatively low among HDHP enrollees, with 14% of people doing so.

Health Populi’s Hot Points: It is important to note that consumers were least likely to wrestle with cost issues when it came to inpatient care — which is the most expensive component of the overall healthcare bill, accounting for about 40% of all healthcare spending. However, the hospital bill for a bed and associated services is among the least transparent line items to the consumer. Buying prescription drugs has a more transparent patient-consumer experience at the point-of-purchase in the pharmacy (in the form of a co-pay, coinsurance percentage, or retail price). This has opened patients-as-consumers up to understanding healthcare in terms of retail experiences and expectations.

Health Populi’s Hot Points: It is important to note that consumers were least likely to wrestle with cost issues when it came to inpatient care — which is the most expensive component of the overall healthcare bill, accounting for about 40% of all healthcare spending. However, the hospital bill for a bed and associated services is among the least transparent line items to the consumer. Buying prescription drugs has a more transparent patient-consumer experience at the point-of-purchase in the pharmacy (in the form of a co-pay, coinsurance percentage, or retail price). This has opened patients-as-consumers up to understanding healthcare in terms of retail experiences and expectations.

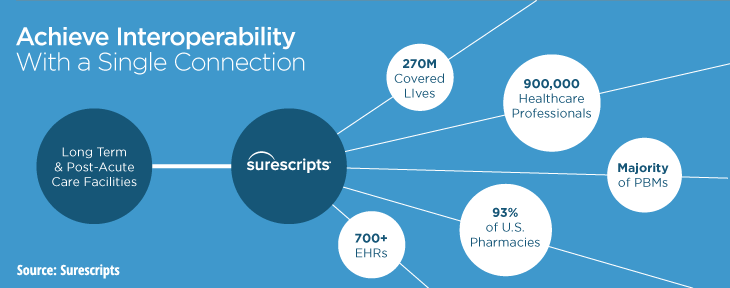

Kullgren and team recommend that health systems make prices for services available at the point of care to inspire patient-clinician conversations about cost; and, that employers and insurance plans help patients learn how to use pricing information in their health care decision making. There’s a new project announced by Cerner, Epic, and other health IT companies who hold large market shares of the electronic health records market (EHRs), collaborating with Surescripts to channel patients’ prescription drug costs at the point-of-prescribing. Working with the PBMs Caremark (owned by CVS) and Express Scripts, this network would cover nearly two-thirds of U.S. patients. The ultimate objective will be, at the point-of-care, to deliver personalized information about the patient’s financial responsibility for a medication and therapeutic alternatives that could be appropriately prescribed as lower-cost substitutes. “Particularly for our members in a high-deductible plan, clarity around prescription drug costs is vital,” Dr. Lynne Nowak, VP of Clinical and Provider Solutions for Express Scripts, said in the press release.

Here is CVS’s news about real-time prescription drug benefits information, announced today.

This project is but one approach to channeling relevant information to patients building healthcare consumer muscles, and it’s a welcome one that helps to boost health IT interoperability — still a challenge for EHRs in support of patient engagement. But people will expect and need more complete and personalized health care cost and quality information in their own hands to support their consumerism.

The post High-Deductibles Do Not Automatically Inspire Healthcare Consumerism appeared first on HealthPopuli.com.

High-Deductibles Do Not Automatically Inspire Healthcare Consumerism posted first on http://drugsscreeningpage.blogspot.com/

No comments:

Post a Comment