A response to Amazon’s potential moves in healthcare and pharmacy…strategic positioning for the post-Trump healthcare landscape…vertical integration to better manage healthcare utilization and costs…these, and other rationale have been offered by industry analysts and observers of the discussions between CVS and Aetna, for the former to acquire the latter.

A response to Amazon’s potential moves in healthcare and pharmacy…strategic positioning for the post-Trump healthcare landscape…vertical integration to better manage healthcare utilization and costs…these, and other rationale have been offered by industry analysts and observers of the discussions between CVS and Aetna, for the former to acquire the latter.

“A pharmacy chain buying a health insurance company?” many have asked me over the past few days. These inquiring minds include people who work both inside and outside of health/care.

I ask back: in 2017 and in the future, “What is a pharmacy? What is a health plan?”

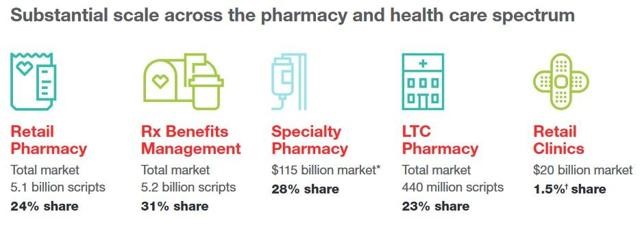

See the first graphic, which is CVS’s picture of their company portrayed in their investor fact sheet published in February 2016. The image tells us that CVS operates in five healthcare segments: retail pharmacy, pharmacy benefits management (PBM), specialty pharmacy (SPM), long-term care pharmacy, and retail clinics. The company serves 75 million PBM members, and operates 1,100 retail clinics and 9,500 brick-and-mortar retail pharmacies. The rebranding of CVSHealth is as “a pharmacy innovation company,” the fact sheet notes. In terms of consumer brand equity, CVS ranks highly on many Fortune lists, Barron’s Most Respected Companies, Harris Interactive Reputations study, and FutureBrand Index Top 100 roster.

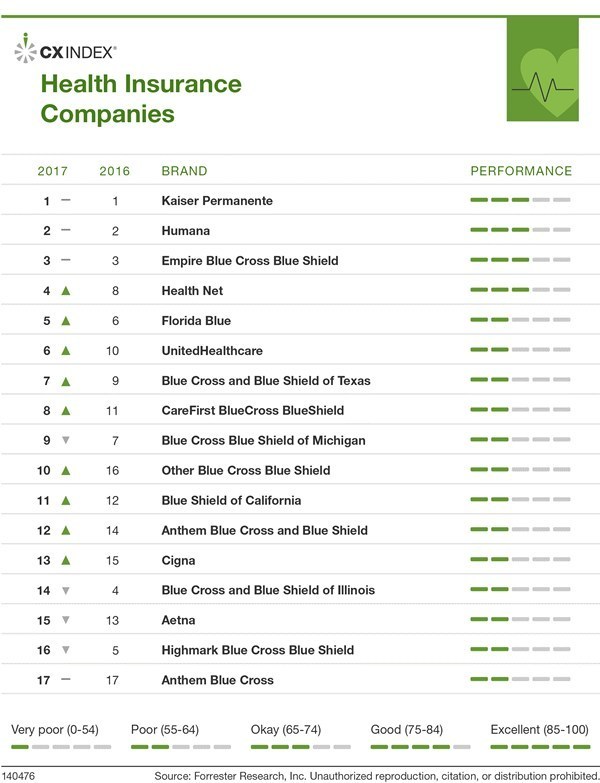

Aetna? Not so much. For example, Forrester’s 2017 CXIndex for Health Insurance Companies ranked Aetna 15th out of 17 plans rated, dropping 2 positions since 2016. J.D. Power’s 2017 Member Health Plan Study rated Aetna at the bottom of the plans surveyed for consumer satisfaction. Aetna also ranked below the average health plan results in The Harris Poll 2017 Equi Trend “brand of the year” study below Blue Cross and Blue Shield, Health Net, Amerigroup, Anthem, and UnitedHealthcare. Aetna’s private plans rank mid-range to low performing on a state-by-state basis in the 2017 NCQA Health Insurance Plan ratings.

As patients are exposed to greater first-dollar costs for their healthcare visits and products (namely, prescription drugs), they are seeking greater levels of service, accessibility, convenience, and enchanting design. Health insurers get poor grades on customer service overall: here’s Bruce Temkin’s latest findings in his group’s annual ratings survey. Note where health plans are, at the bottom and to the left — signifying the least-satisfying customer experiences overall in consumer-facing industries, as opposed to grocers, fast food, retailers, and package delivery companies (THINK: Amazon Prime delivered via UPS, USPS, and FedEx gaining the halo from immediate gratification of goods received).

As patients are exposed to greater first-dollar costs for their healthcare visits and products (namely, prescription drugs), they are seeking greater levels of service, accessibility, convenience, and enchanting design. Health insurers get poor grades on customer service overall: here’s Bruce Temkin’s latest findings in his group’s annual ratings survey. Note where health plans are, at the bottom and to the left — signifying the least-satisfying customer experiences overall in consumer-facing industries, as opposed to grocers, fast food, retailers, and package delivery companies (THINK: Amazon Prime delivered via UPS, USPS, and FedEx gaining the halo from immediate gratification of goods received).

While the rationale for the deal may be focused more on pharmacy benefit management, consumers may receive other service-related benefits that are transparent and valuable to their everyday lives. Vertical integration of more elements of peoples’ fragmented healthcare experience can benefit peoples’ utilization of healthcare and also the outcomes derived from that experience. This can happen throughout the 360-degrees of healthcare experience, from initial enrollment to schedule appointments, paying bills, using apps, and receiving healthcare advice via text or other communications channel. Health coaching can happen when data from healthcare claims (say, what’s in Aetna’s systems) mash up with CVS’s pharmacy claims data from both PBM and SBM (pharmacy and specialty), along with patient-generated data via apps and wearable health/med technology.

Interestingly, Walgreens Balance Rewards program awards points to program members who link their wearable med-and-health tech devices to the program, so millions of consumers are already comfortable sharing their personal health data generated via apps and devices Fitbit wristbands, Misfit fobs, AccuCheck blood glucometers, and Omron blood pressure monitors, among others. CVS could implement such a program, which would enrich the data mine to help people better manage their health through coaching based on real-life (and nearly real-time) data-informed feedback.

As people continue to embrace the fact that health can be made where we live, work, play, pray and learn, CVS has worked to become more accessible. The company’s recent piloting of vending machines is one example of this retail experiment. (This is a favorite concept of mine, discovered last year in a kiosk in Florence, Italy, adjacent to a pharmacy across from Dante’s old palazzo).

CVS also recently launched a curbside pick-up service akin to that fast food/fast coffee window; remember that consumers rank fast food highly as a service in the Temkin experience poll.

This Health Populi post was written through the lens of consumer experience, and doesn’t covered the intricacies of the pharmacy or PBM business angle–which are significant. For an excellent perspective on that, you can trust the Washington Post’s coverage featuring insights from my colleague Adam Fein of the Drug Channels blog.

Health Populi’s Hot Points: Today is 1st November, so I thought I’d share a lovely old Aetna calendar page captured on the Aetna history website.

Health Populi’s Hot Points: Today is 1st November, so I thought I’d share a lovely old Aetna calendar page captured on the Aetna history website.

The CVS+Aetna merger discussions at this time are a signal of larger health/care market forces: America’s unsustainable cost-increasing delivery system model; consumers’ greater exposure to healthcare costs coupled with peoples’ demand for DIY self-care and convenience; the influx of more high-cost specialty drugs with six-figure price tags, and the question of “who” will pay for innovation to solve healthcare’s toughest diseases; and, Amazon’s latest forays into health, healthcare, and consumers’ retail lives, among other drivers.

I’ve forecasted for several years that the person’s home is and should be their true medical home — not the doctor’s office, as the “medical home” concept is currently defined. Self-care is one flavor of health reform at the personal level, which I wrote about one year ago in the Huffington Post.

That was November 8, 2016, and today is November 1, 2017. One year from now, we’ll know whether CVS Health and Aetna will be a combined entity that goes beyond CVS’s current concept of a “pharmacy innovation company.” By then, the organization may, together, be a real health/care innovation engine.

Until then, we should remember that the core business of pharmacy is key to peoples’ wellbeing and accessible healthcare services boosting self-care. So I recommend you watch this fantastic video from the inspiration ZDoggMD on the power of the pharmacist — who after nurses are, according to Gallup, the second most-trusted professional in America.

The post A Health Consumer Perspective on CVS+Aetna appeared first on HealthPopuli.com.

A Health Consumer Perspective on CVS+Aetna posted first on http://drugsscreeningpage.blogspot.com/

No comments:

Post a Comment